Summary

Regarding the multiplier effect, we expect the coming round of U.S. infrastructure investment will be a total of USD4 trillion, an annual average of USD500 billion. After the offset of an annual average tax increase of USD133.3 billion, the investment could boost U.S. GDP by around 1.8% in 2021. This round of U.S. infrastructure investment looks similar to China's RMB4 trillion stimulus package in 2009, which will possibly lead to higher inflation in the coming two years. Compared with the performance of different China’s asset classes from 2009 to 2011, we believe that there are rooms for further increases in housing prices (REITs) and commodities. We remain bullish on the performance of Bitcoin in Q2, while believe that the infrastructure investment is neutral towards USD. We prefer cross-trades such as short EUR/GBP, short AUD/CAD, etc. at this moment.

What is the scale of the Biden administration's infrastructure investment?

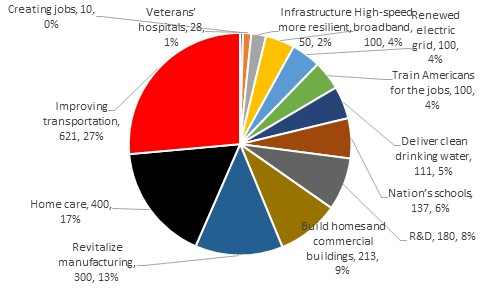

On March 31st, the White House unveiled a detailed plan for government infrastructure, with a total investment of USD2.35 trillion over the next eight years, covering 13 sub-items in six categories, particularly in improving transportation, homecare, manufacture, supporting small and medium-sized enterprise, improving housing and commercial infrastructure (Figure 1).

With reference to China's prior experience, infrastructure investment has a multiplier effect, in which, for every dollar of government infrastructure investment, it can leverage 2 dollars of total social investment. Hence, the State’s USD2.35 trillion infrastructure investment plan is expected to monetize about USD4 trillion of total social investment. The average annual investment will be USD500 billion, accounting for 2.4% of U.S. GDP.

Figure 1: Breakdown of Biden’s infrastructure plan (Bn USD)

Source: White House, Goldhorse capital

To what extent it could lift U.S. GDP?

The Biden Administration will improve the economy through infrastructure investment, it will also finance infrastructure investment via increasing taxes. The White House expects to raise about USD2 trillion in federal taxes over the next 15 years, an annual average of USD133.3 billion, equivalent to 0.6 % of U.S. GDP.

If the infrastructure investment and tax increase policies are implemented, we expect it will lift U.S. GDP by around 1.8% (2.4%-0.6%) in 2021, while the U.S economy will face a larger upside risk in the coming year.

Why is U.S. infrastructure investment similar to China's RMB4 trillion stimulus package in 2009?

The U.S. has chosen the similar way that China improves its economy by infrastructure investment, which china's infrastructure investment grew by 42.2% in 2009. One of the similarities is that the U.S. has faced years of aging infrastructure, lacking incentive and problems of large infrastructure gap. Hence, the infrastructure investment would start to take off this year.

Additionally, China's M2 grew by 27.7% in 2009, while the current M2 growth rate in the U.S. is 27%, reflecting monetary expansion is equally significant.

This leads to a similar outcome for the State’s future - high inflation. With reference to China's CPI in July 2009, it bottomed out at -1.8% and reached as high as 6.5% in July 2011. From our point of view, the inflationary pressure in the U.S. in the coming two years cannot be underestimated.

What will be the impacts on global large asset classes?

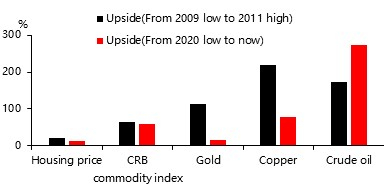

According to China's prior experience in 2009, infrastructure investment would boost housing and commodity prices.

- Housing prices: According to the National Bureau of Statistics of China, the price of first-hand commercial housing (within the 70 large and medium-sized cities) rose by 21% from 2009 to 2011 (in fact, they are still undervalued), while current housing prices in the States have risen by only 13%, suggesting there is still room for a further price increase (Figure 2).

- Commodities: CRB commodity prices rose by 65% from 2009 to 2011, while current commodity prices are up by 58% and there is still room for further improvement, particularly for copper and gold, which are still significantly lower than 2009-2011’s levels (Figure 2).

- We are bullish towards Bitcoin: The U.S. infrastructure investment will further increase U.S. inflation, and the allocation rebalancing between Bitcoin and gold by institutional investors. Both will favor Bitcoin's performance in Q2.

- USD: We remain slightly neutral towards the dollar. On one hand, infrastructure investment will increase GDP growth and support the dollar. On the other hand, it will trigger higher inflation and lower the real interest rates, which is negative towards the dollar. Combining these two effects together, we remain slightly neutral towards the dollar. Hence, we prefer cross trades such as short EUR/GBP and short AUD/CAD, at this moment.

Figure 2: Compared with 2009-11, housing price and commodities still have much upside potential

Source: Wind, Goldhorse capital